Netflix and Comcast recently announced an agreement whereby Netflix will pay Comcast for direct access to its network. This agreement addresses congestion that is slowing delivery of Netflix videos to Comcast’s broadband subscribers and resolves a dispute between the two companies concerning how to pay for the needed network upgrades. Netflix and Verizon are currently working through a similar dispute. While some commentators think deals such as the one between Netflix and Comcast are problematic, the reality is that the agreement reflects a common market transaction that yields an outcome more efficient and more quickly than any regulatory intervention could have.

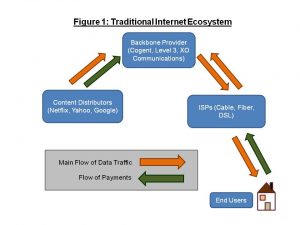

The following series of stylized figures illustrate how the growth of Netflix and other streaming video services have affected the volume and flow of internet traffic and corresponding payments in recent years. Traditionally (Figure 1), Internet backbone providers and ISPs entered into “peering” agreements, which did not call for payments on either side, reflecting a relatively balanced flow of traffic. Content distributors paid backbone providers for “transit,” reflecting the unbalanced flow of traffic along that route.

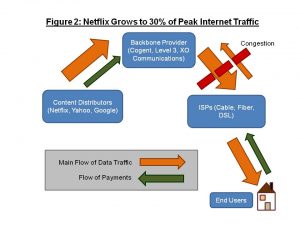

With the growth of online video and with Netflix accounting for 30 percent of traffic at some times of the day, this system was bound to become strained, as we are now seeing and as shown in Figure 2. The flow of traffic between the backbone provider and the ISP is unbalanced and has grown enormously, requiring investments in additional capacity.

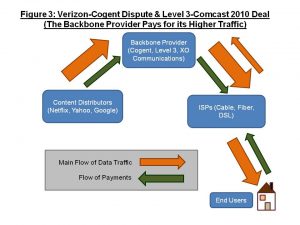

One way to address this problem is for the backbone provider to pay the ISP, reflecting the greater amount of traffic (and greater capacity needed) going in that direction (see Figure 3). In fact, that is what happened following a dispute between Level 3 and Comcast in late 2010.

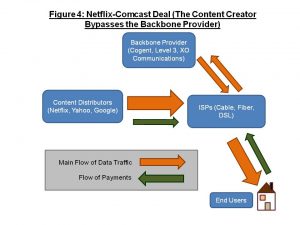

Another solution is the just-announced Comcast-Netflix deal, reflected in Figure 4. In this case, Netflix/Comcast is bypassing the intermediate backbone provider (either partially or completely), presumably because it is more efficient to do so. One or both of them is investing in the needed capacity. Regulatory interference with such a deal runs the risk of blocking an advance that would lower costs and/or raise quality to consumers.

The Wall Street Journal has described the debate as being “over who should bear the cost of upgrading the Internet’s pipes to carry the nation’s growing volume of online video: broadband providers like cable and phone companies, or content companies like Netflix, which make money by sending news or entertainment through those pipes.” Ultimately, of course, consumers pay one way or the other. When Netflix pays Comcast, the cost is passed through to Netflix subscribers. This is both efficient and fair, because the consumer of Netflix services is paying for the cost of that service.

In the absence of such an agreement, quality would suffer or the ISP would bear the cost. The ISP might recover these costs by increasing prices to subscribers generally. This would involve a cross-subsidy of Netflix subscribers by non-subscribers, which would be neither efficient nor fair. Alternatively, Comcast could increase prices for those subscribers who consume a lot of bandwidth, which might have similar effects to the just-announced deal, but would probably lose some efficiencies. In any event, it is difficult to see how such an arrangement would be better for consumers than the announced agreement.